Slovak Startup Datamolino Bags €500K To Make Accountants’ Lives Less Boring

Spare a thought for accountants. Slovak startup Datamolino has, by building a platform for SMEs to cut through the tedium of manual data entry of invoices and receipts, and it’s proving to be a lucrative idea — as the b2b startup has just bagged €500,000 ($680K) in seed funding, and is already in discussions for raising a full Series A.

This follows the €40,000 Datamolino received to develop its product during an eight-month incubation period at Wayra’s Central & Eastern Europe Academy, based in Prague.

Datamolino is the first graduate from Wayra Prague to get follow-on funding after participating in the program, which kicked off its first cohort last year.

Globally, the Telefonica-backed network of incubators has a fairly decent rate — of circa 40% — for graduating startups securing their next tranche of cash. Out of a global total of 174 Wayra graduates, 70 startups have gone on to receive follow on funding, the accelerator confirmed to TechCrunch.

Datamolino’s follow-on funding is being financed by the Slovak Innovations and Technologies Fund (FIT). Founder Andrej Glezl said it will use the money for European expansion, and to see it through from its current closed beta phase to a public beta and then full commercial launch (after May) — with the financing going on things like implementing customer feedback into the product and kicking off online marketing.

It’s also aiming to integrate its system with other relevant SME-targeting b2b software packages to foster further spread. ”There is a huge opportunity to implement [Datamolino] with solutions such as Sage One, Quickbooks, Xero, etc,” he says. “Our product has to go through technical and marketing review with such firms — the seed funding should ensure we can get through that.”

It’s actively working with Telefonica to get its product added to O2 cloud too, which targets the same SME segment of customers — a connection forged via the Wayra link.

Glezl says size of the opportunity Datamolino is targeting is the vast majority (80%) of the 150 billion invoices generated globally each year which are unstructured invoices — i.e. paper, scans and PDFs — as these can be processed by its system to save its customers time (and thus money).

In Europe the annual figure is 16 billion unstructured invoices globally. And it’s not just paper receipts that are the problem Datamolino is fixing; even e-invoices can cause headaches for accountants if they are generated as PDFs, says Glezl.

“That’s where our services comes in handy — we can turn [a PDF] into a structured document,” he says, adding: “There are very few countries where digitalisation is government driven (e.g. Finland). But most countries end at PDF level of digitisation. And that’s why our service remains very relevant also in the future.”

Bottom line: paper (and PDFs) persist — providing an opportunity for better processing technologies.

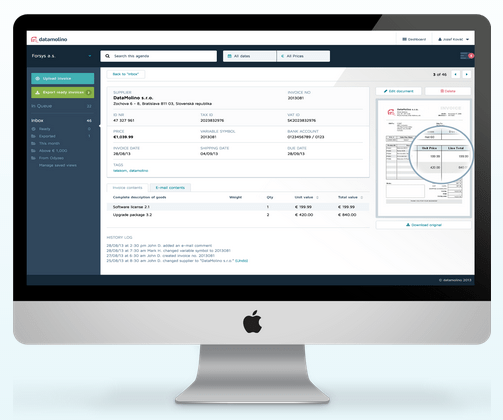

Datamolino uses a blend of optical character recognition technology for quickly processing paper, scans and PDF invoices/receipts to cut out the need for accountants and SMEs to do manual data entry.

It also employs human checkers as a service differentiator from competitors in the space — and also a premium upsell to offer the highest data accuracy assurances.

“The key differentiator is in the architecture of our product from the user’s perspective and also the fact that we have a service on top of the software. i.e. if a business want’s to make sure that all data that are extracted with the help of the software are accurate, we have the verification center to support this,” explains Glezl, who argues that this human element makes the service comparable with the in-house invoice processing departments used by large corporations.

Datamolino’s ability to process both invoices and receipts, as well as also tackle scans, also sets it apart from some of its competitors, according to Glezl, who names the main competitors as Shoeboxed, Receipt Bank, Celaton and Invitbox.

Another aspect of its offering is that it securely stores the processed invoices in the cloud, providing a back-up and repository service as part of its b2b sell. “Our product is built primarily so that it is used by accounting professionals,” he adds.

Currently Datamolino has 180 customers as part of its closed beta, and plans to open up a public beta in March — ahead of the full commercial launch later this year.

While European expansion is the initial focus for Datamolino, Glezl also describes LatAm and the U.S. as promising markets. The startup is currently weighing whether to open headquarters in London, to support its expansion plans, or in Brazil or the U.S. — the other possible locations.

Commenting on the funding round in a statement, Rastislav Roško, deputy chair of the FIT board of directors, said: “Datamolino is developing an innovative service that can streamline the administration of any business. Our discussions with Datamolino have satisfied us that they have a first-class team capable of seeing their project through successfully. We are confident that the FIT investment will enable Datamolino to establish itself in EU markets.”