Fast-Growing Zenefits Adds Commuter Benefits, Flexible Spending And 401(k) Support As It Moves To Take Over Startup HR

Managing human resources is one of the more frustrating and time-consuming aspects of running a startup or small business. Because most can’t afford to hire an HR person, all that paperwork usually falls into the lap of founders and management. Knowing that entrepreneurs would rather spend their time growing their business rather than wading through administrative tasks and insurance forms, Zenefits launched in early 2013 to help small businesses remove some of the pain inherent to managing HR.

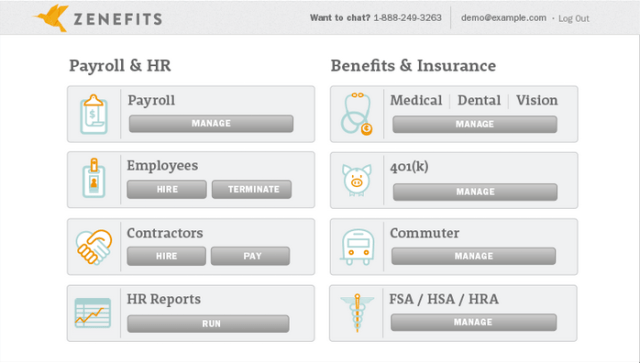

Initially, the company set out to create a platform that would automate the process of setting up and managing group health coverage and payroll, enabling resource-strapped businesses to move administration online (for free) without having to dip into their hiring budget. But Zenefits Co-founder Parker Conrad says that the team quickly found that startups were using the system not just for managing health coverage and payroll, but as an alternative to traditional HRIS or Human Resources Information Systems. In other words, to manage all HR-affiliated tasks.

Since then, Zenefits has focused on building out more of those core HRIS features in an effort to allow companies to manage benefits, payroll, HR and everything in between in one place. Soon, the company added the ability for startups to automate hiring and firing of employees, auto-generating the necessary documentation (letters, employee handbooks, agreements and so on).

It allows those in charge to add and remove staff from the payroll, for example, while sending automatic alerts to employees and admins via email. In turn, customers can also use Zenefits to track paid time off (or PTO) so that employees can apply for time off, while allowing managers to view balances, liabilities and a calendar of their team’s schedule.

This winter, Zenefits is moving even deeper into the territory of enterprise HR services, like that of Workday, HP and many more by continuing to expand its coverage. Today, Zenefits has begun to offer commuter benefits, flexible spending accounts and HRA that can be integrated directly into a business’ HRIS and payroll.

These types of plans, which are all pre-tax, allowing employees to save 40 percent on commuting costs, medical costs, childcare costs and, in the case of the HRA, let employers pay deductibles with those pre-tax dollars. This, like all admin and HR work, is a headache to set up and administer, requiring individual applications for each employee and forcing management to manually set up employee deductions in payroll themselves.

Zenefits, as you might have guessed, automates that process, enabling customers to enroll in less than a minute and sweeten the deal for employees by offering a single debit card, which they can use for purchases across their plans. While there is a laundry list of companies competing across HR, health coverage, payroll and benefits categories, Zenefits claims that its the “first of its” (HR automation) kind to “provide all-in-one debit cards that integrate with HR systems and payroll right out of the box.”

With these new commuter, FSA and HRA benefits, Zenefits wants to fully-integrate everything HR-related and put it in one place, offer one card, allow employees to make contributions to reduce their taxable income and have Zenefits set up and run discrimination and compliance tests for your business.

Lastly, the startup is also launching its own affordable 401(k) service, in which companies pay a $495 one-time setup fee and $105/month in account fees, while employees pay $4/month + 7bps annually. In turn, Conrad says, the fees that it does charge to use these services are charged by the 401(k) provider and Zenefits doesn’t “tack on a penny.”

The startup’s new 401(k) also allows founders to skip the process of transferring payroll data to the 401(k) provider each quarter, automatically doing this for them in a few clicks. Zenefits also automates the employee on-boarding process and bringing new hires online, paperlessly.

If the employee chooses to enroll, the system automatically adds the deduction into the TC payroll system. Employees can then choose from over 40 Vanguard mutual funds and ETFs and customize by selecting different funds. According to Parker, businesses can enroll in 3 minutes online just by creating an account or logging in and clicking the “Setup” header under 401(k).

By expanding its HR and benefits coverage to include commuter, FSA, HRA benefits and a fully-baked 401(k) — and by continuing to round-out its platform — Zenefits is well-positioned to take advantage of the growing demand for better, more flexible HR services. Especially for those that cater to medium-sized and small businesses alike — part of why Zenefits’ core focus has traditionally been on companies that are between 50 and 300 employees.

Going forward, however, Conrad says that he expects Zenefits to continue to broaden its scope and to begin going after bigger and bigger companies. So far, the company’s efforts to expand into a full-service platform and serve the whole pipeline have been paying off.

The Zenefits CEO tells us that the company’s overall growth rate has been doubling every six weeks — and 4x quarter-over-quarter growth — which is quickly making Zenefits a force to be reckoned with in this space. In less than a year, Zenefits’ payroll, benefits and HR management tools have attracted over 500 companies and is now helping them managing more than 5,000 employees.